This is a paid advertisement sponsored by American Lithium Corporation

Chinese Lithium Squeeze Could Make Tonopah, Nevada, USA, The Center of The Green Energy Revolution…

Jim Woods is a 20-plus-year veteran of the markets with varied experience as a broker, hedge fund trader, financial writer, author and newsletter editor.

His books include co-authoring, “Billion Dollar Green: Profit from the Eco Revolution,” and “The Wealth Shield: How to Invest and Protect Your Money from Another Stock Market Crash, Financial Crisis or Global Economic Collapse.” He’s also ghostwritten many books and articles, as well as edited content for some of the investment industry’s biggest luminaries.

- That, in turn, could highlight a company embracing a potential breakthrough in lithium mining.*

- Like most 21st Century lithium plays, this is a speculation… but it’s one that comes with a twist.

- Their lithium company is now at an advanced stage, potentially perfect for an era when analysts warn, the chance of a “perpetual” lithium shortage is real.[3]*

A potentially lithium-rich, 19.5-square-mile swath of desert near Tonopah, Nevada, USA, could soon become an important participant in the green energy revolution.[4]

The reasons are straightforward.

This dusty stretch of earth holds 8.83Mt (LCE) M&I and 1.86Mt inferred of lithium carbonate resources (LCE).[5]

American Lithium’s testing indicates strong extraction rates over 90% and the possibility of making a high quality lithium product.[6]

The potential for developing a massive lithium deposit couldn’t happen at a better time.*

That’s because lithium demand is forecasted to spike 400% during the next seven years.[7]

Perhaps best of all, these potential lithium reserves sit in the heart of the Free World… Nevada, U.S.A.

And the importance to the world cannot be overstated.[8]

That’s because, as you’ll see, China and Chile have become puppet masters… pulling the strings and making the lithium market dance to their tunes.[9][10]

NASDAQ: AMLI Could Balance The Scale In The Free World’s Favor

So, as global chaos could find the green energy revolution hanging in the balance, the importance of FREE WORLD LITHIUM becomes more magnified.[11]

And that’s why it may be time to pay attention to American Lithium (NASDAQ: AMLI).[12][13]

On NASDAQ and the Canadian TSX Venture Exchange, American Lithium is listed as a Top50 TSX Venture company.[14a]

Most importantly, though, American Lithium (NASDAQ: AMLI) is in complete control of a lithium-rich 12-square-mile property located outside of Tonopah, NV.

Moreover, American Lithium, with its large lithium resource and a potentially highly effective way to mine and extract it, is run by an accomplished team of mineral explorers and developers.

They’ve led and founded prominent mineral companies such as Millennial Lithium, Prime Mining, Osum Oil Sands, M2 Cobalt, and Kodiak Copper.[15]

These mining industry leaders may have been drawn to American Lithium (NASDAQ: AMLI) for the same reason readers should take interest.

You’ll find those reasons here in American Lithium’s timely story.

“STAGGERING”

The Demand For Lithium Is Almost Hard To Comprehend

“We’ll hit the first million [metric tons] of demand within the next few years,” says Cameron Perks, a lithium expert with Benchmark Minerals Intelligence. “And then thereafter every few years adding another 1 million [metric tons] … every few years, which is staggering.”

SOURCE: NPR https://www.npr.org/2022/11/23/1135952359/lithium-mines-batteries-electric-vehicles-climate-change-carbon

Lithium Supply Chain May Soon Need A Free-World Liberator Like American Lithium (NASDAQ: AMLI)

My name is Jim Woods. Once I knew I’d be paid to show you this report, I started researching the facts at the heart of it.*

Like many Americans and Canadians, I already knew that lithium was central to the electric vehicle and green energy industries – central to the future…

Central to a new industrial revolution that could be worth as much as a combined $2 trillion in the next seven years.[16][17][18]

But I didn’t know there were dark clouds and rumbling thunder in the distance.

It’s why this potential supply-chain trouble is a good reason for the focus on Nevada.

It could be an even better reason to focus on a company such as American Lithium (NASDAQ: AMLI).

That’s because a geologist’s report suggests that American Lithium could have the potential to mine 8.83Mt (LCE) M&I and 1.86Mt LCE inferred of lithium.[19]

Of course these potential resources are based on preliminary numbers and do not indicate economic viability. They are just a sign of progress for this exciting exploration company.

Whether Lithium Boogeyman Or Voracious Competitor…

China's A Problem

That’s because the lithium supply chain is downright one-sided. It tilts heavily toward China.

In fact, China has 60% of the world’s capacity to transform raw lithium into battery-grade lithium… [20]

Moreover, Bloomberg just reported that China’s domestic share of global passenger EV sales grew from 26% in 2015 to 56% in the first half of 2022.[21]

The expectation now is for its slice of the global EV market to reach 60% this year.[22]

That’s not even considering that the percentage of global sales for trucks, buses and two-wheeled vehicles is even further ahead.[23]

So, the real fear is that hyper-paced growth could lead to tension over where Chinese lithium producers will direct their product should supply run short.[24]

And then consider bad intentions.

As Abigail Wulf put it, a Chinese tantrum could hamstring the American EV industry.

“If China wanted to cut off supplies of processed materials for Li-ion batteries, as it did with rare-earth materials to Japan in 2010, it would create a dire situation,” said Wulf, the director of the Center for Critical Minerals Strategy at Securing America’s Future Energy.[25]

That’s why Free World companies such as American Lithium (NASDAQ: AMLI) could play an essential part in securing the U.S.’s energy future.

Chile Could Chill The Lithium Supply Chain

So, China is a significant Free World worry.

But another worrisome problem is playing out right now, too.

It’s happening in Chile, which is said to be home to a whopping 57% of the world’s known lithium reserves.[26]

Chile’s new government had to ally with a Communist minority party for control of its congress.[27]

And now the government wants a much bigger piece of the country’s lithium reserves.

The Wall Street Journal described the potential for a crisis this way…

“Production has suffered at the hands of leftist governments angling for greater control over the mineral and a bigger share of profits.”[28]

Then the WSJ story turned frightening:

It quoted Chile’s Mines Minister Marcela Hernando as telling its congress “that while the government didn’t have the know-how to mine lithium on its own, it would insist on majority control of any joint venture with private firms.”[29]

That sure sounds like pay up or get the hell out.

There are no such issues in Nevada, where Mike Brown, Director of Nevada’s Office of Economic Development, said, “We plan to take the lead in lithium mining.”[30a]

All Signs Point To The Conclusion That Voracious Demand For Lithium Is A Rapidly Emerging Mega Trend

But Nevada is about the future.

And I believe lithium’s future demands are being documented by the huge number of headlines that bluntly state that a massive lithium shortage is looming.

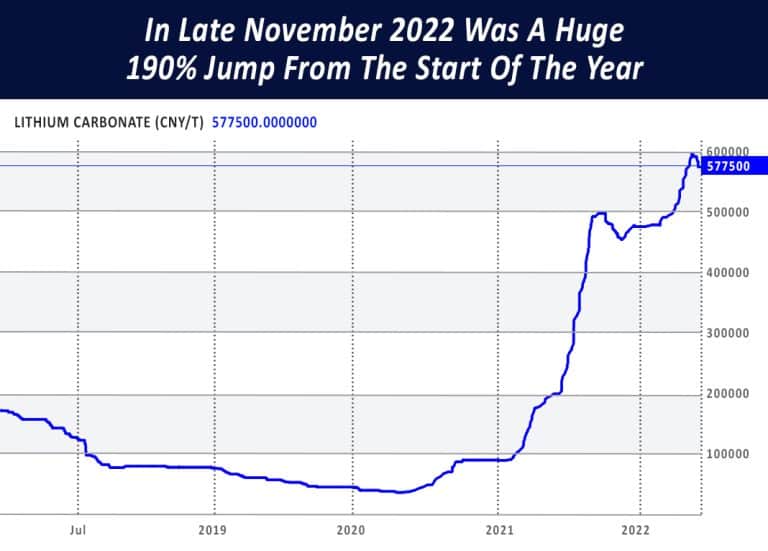

It’s why the price of lithium carbonate continues to climb.[31]

And one of the huge factors in the forecast of massive shortages is that the current group of global lithium miners won’t be able to keep up.[32]

It’s not that they can’t increase production. They can. But demand is predicted to gobble any increases and still leave the market hungry.[33]

In fact, as NPR reported, global lithium production has already doubled in just a few years. Now it needs to do it again. And again… And again…[34]

There need to be new sources… full stop.

And that’s why you’ll see stories and advertising for developers such as American Lithium (NASDAQ: AMLI).

But few, if any, junior explorers are blessed with such a deep bench of managers and directors as American Lithium (NASDAQ: AMLI).

They are sitting on a meaningful lithium deposit, potentially one of the largest in the United States.[35a]

And, at the perfect time.*

Even with all these factors, lithium exploration and development remains a speculative and risky venture, and there is no assurance of success.

Lithium Carbonate At $70,000 A Metric Ton In Late November 2022 Was A Huge 190% Jump From The Start Of The Year

Classic Investing Setup: When There’s A Huge Problem… Buy The Solution

The giant price spike represents demand and the forecast for the future.

But these dramatic lithium headlines also suggest that China and Chile’s vice grip on lithium could slow, or even ruin, the global electrification revolution… and the drive to save the planet.[36][37][38]

Check out these headlines.

While you do, remember they imply that established lithium miners can’t or won’t keep up with worldwide lithium demand.

That means lithium’s future supply could well depend on new lithium exploration and development, such as what’s being done in Tonopah, NV, by American Lithium (NASDAQ: AMLI).

Moreover, American Lithium could be a supply-chain savior because it has a high quality richly mineralized deposit.[39]

![]()

The Place With the Most Lithium is Blowing the Electric-Car Revolution

Aug. 10, 2022 [40]

![]()

Canada Orders Chinese Companies to Divest From Miners After Security Review

Nov. 2, 2022 [41]

Lithium Demand From EVs Is Strong. Shortages Will Keep Prices High.

Sept. 29, 2022 [42]

Elon Musk says a lithium shortage is holding back Tesla.

Oct. 19, 2022 [43]

Lithium Is Key to the Electric Vehicle Transition. It’s Also in Short Supply

May. 26, 2022 [434]

World faces shortage of lithium for electric vehicle batteries

Jan. 21, 2022 [45]

![]()

Why A Lithium Battery Shortage May Wreck The Great EV Race

April 18, 2022 [46]

EV battery costs could spike 22% by 2026 as raw material shortages drag on

May 18, 2022 [47]

The Trouble With Lithium… a supply crisis of the wonder metal could dent the world’s chances of meeting its climate goals.

May 25, 2022 [48]

As you can imagine, this list could go on and on.

So, let me add one final word about the headlines and me.

There’s A Target On Nevada Lithium…

American Lithium (NASDAQ: AMLI) Could Be The Bullseye

In my years as a newsletter editor American Lithium (NASDAQ: AMLI) is one of the few companies I’ve researched that was a true stand-out opportunity.*

That said, I would also agree that one of lithium’s true positives is that it’s likely a decades-long market.[49]

As I’ve noted, Tonopah, Nevada could be in the heart of the action… the pulse.

That’s because American Lithium (NASDAQ: AMLI) may be one of the most farsighted lithium developers you may come across.*

Its TLC, NV, project is proof.

Because, if you’ve read this far – you likely are interested in lithium projects… and how they could profit from a skinny, tight supply-chain.

It also means you’re aware that it seems like every junior mineral explorer and their brother has flocked to Nevada during the past few years.

There’s a reason: Nevada holds a lot of lithium.

In fact, it’s thought that Nevada may hold as much as 25% of all the world’s lithium.[50]

Despite the statewide potential, it also seems as if many of the junior explorers with lithium-rich dreams have raced into Clayton Valley and Thacker Pass.

In all, there are 40 major lithium mining projects in Nevada’s Division of Minerals approval pipeline.[53]

American Lithium Had The Foresight To Explore For A Different Kind Of Concentrated Lithium… Lithium Clay

Of the several dozen companies exploring for lithium in Nevada, * (NASDAQ: AMLI) is by far one of the several most advanced and is well-positioned to be a potential front-runner in the bid to beef up America’s lithium production.

Its founders, Michael Kolber and Andy Bowering explored Nevada in search of a new form of the battery metal.

It’s lithium claystone, found in the ground at shallow depths.

They found it in Tonopah. Thousands of acres of lithium clay. In all, 12 square miles.

Notably, Bowering is also a founder of Millennial Lithium, purchased by Lithium America’s for nearly $300 million USD (US$3.51 a share) in 2021.[54] Those shares once traded for pennies.[55]

Bowering also founded Prime Mining (PRNMF), which also looks to have treated its early investors well with a market cap of approximately $200 million USD.[56]

Now The Excitement Starts With American Lithium (NASDAQ: AMLI)

There are several stages in a mine’s life.

Each is a benchmark that moves toward actually building a mine.

Today, American Lithium (NASDAQ: AMLI) is a lithium development company.

But, after two years of vigorously exploring its massive TLC lithium claystone project, American Lithium could signal more to come.

First, the company has a large lithium resource base and is nearing the completion of its maiden Preliminary Economic Assessment at its TLC project in Nevada.

It’s a major step towards developing the project.

Investing News says a PEA usually details pre-production capital costs, life-of-mine sustaining capital, mine life and cash flow, and details on processing and production methods and rates.[57]

More importantly, in a November 2022 presentation, American Lithium (NASDAQ: AMLI) said it plans to commence the Pre-Feasibility process in 2023.[58]

In this case, American Lithium (NASDAQ: AMLI) reported in a government filing that its TLC project holds 8.83 million metric tons of measured and indicated LCE.[59]

So, with lithium carbonate selling over $70,000 a metric ton[60], you can see the implication is potentially staggering.

Anyway, a prefeasibility study is another crucial step in the progression of American Lithium (NASDAQ: AMLI) and its TLC project.

So, you can see it’s an important evaluation for new investors and suitors.

If all goes well, and the prefeasibility study expected next year provides positive indicators, it should be followed by a feasibility study that provides a definitive technical, environmental, and commercial basis for a mine.

In Nevada, technical, environmental, and commercial are huge positives because the state is mining-friendly and has plenty of modern infrastructure along with a skilled workforce.[61]

In The Desert, Water Is A Key To A SUCCESSFUL MINING OPERATION, Which May Be A Blessing For American Lithium (NASDAQ: AMLI)

Scratch the surface of Nevada’s lithium industry – some call it the white gold rush[62] – the fight for water jumps forward.

Thirty companies hope to mine lithium in Nevada’s Clayton Valley… but one established player controls most of the water.[63]

Albemarle Corp (ALB) has Nevada’s only working lithium mine.

And it holds almost all the water rights in all of Clayton Valley — about 20,000 acre-feet in total.

That leaves 29 thirsty competitors.

Moreover, Albemarle wants to double its current output to 10,000 metric tons of lithium carbonate annually.[64]

“Our position quite simply has been there is no water to be given to anyone because we have all the water rights,” said Karen Narwold, Albemarle’s executive vice president and chief administrative officer.[65]

“And we’ve been operating for many years here and can successfully show that we’re actually making a commercial product.”[66]

Outside Clayton Valley, In Tonopah, NV, American Lithium (NASDAQ: AMLI) Has Already Secured Its Water Rights

By my count – there are just four lithium companies that have unfettered water rights in Nevada.

Albemarle and Cypress Resources in Clayton Valley. Gemini Lithium in Lida Valley.[67][68]

American Lithium (NASDAQ: AMLI) is the other one.[69]

Imagine that. In the race for Nevada lithium, American Lithium (NASDAQ: AMLI) could be miles ahead.*

That doesn’t mean you shouldn’t look at Nevada’s other junior explorers or developers.

But it means today, American Lithium is only beholden to its shareholders.

That’s because it has acquired 2,500 acre-feet of water rights.[70]

Which will be sufficient to sustainably support initial development.

It owns it free and clear after buying two farms and other agricultural property in the Big Smoky Valley near Tonopah.[71]

By the way, an acre-foot of water is what it takes to cover one acre with one foot of water.

Embrace The Future With American Lithium (NASDAQ: AMLI)

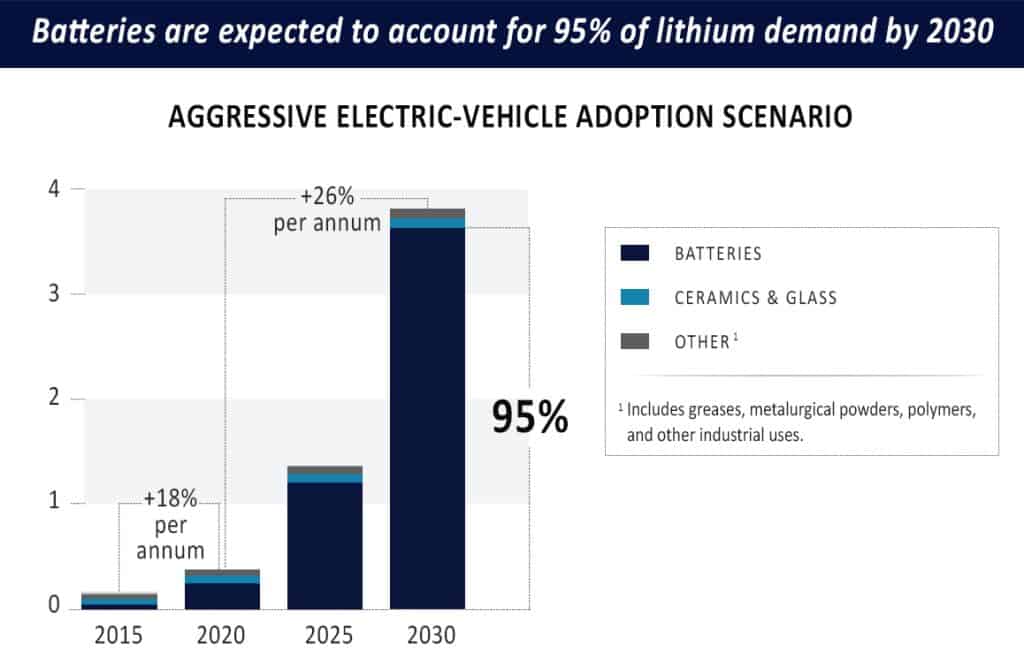

It wasn’t that long ago when less than 30% of lithium demand was for batteries.

That was back in 2015 when analysts at McKinsey & Company found that the bulk of lithium demand was “split between ceramics and glasses (35%), greases, metallurgical powders, polymers, and other industrial uses (35%+).”[72]

Now, the same analysts report that batteries are expected to account for 95% of lithium demand in the next seven years.[73]

That demand could grow annually by 25% to 26% and create a need for 3.3 million to 3.8 million metric tons of lithium carbonate.[74]

Led By Volkswagen, Global Automaker’s EV And Battery Investments Now Top $500 Billion

American Lithium (NASDAQ: AMLI) Could Soon Be In The Heart Of A Half-A-Trillion-Dollar Worldwide Mega Trend

And according to Reuters, “Global automakers are planning to spend more than half a trillion dollars on electric vehicles and batteries through 2030.”[76]

All driven by lithium and the hope for a steady lithium supply chain.

Think of it; the average electric car uses more than 5,000 times the lithium of a smartphone.[77]

An EV that can travel farther because of a denser battery can use as much lithium as is in 10,000 smartphones.[78]

Or, in the words of GlobalX Lithium & Battery Tech ETF analysts… “Therefore, growth of the electric car market will have a profound impact on total lithium demand.”

- In late 2020, Volkswagen raised its planned investment in digital and electric vehicle technologies to $86 billion over the coming five years. Then in December 2021, it said that wasn't enough and bumped it up to $100 billion to hold onto its crown as the world's largest carmaker in a new green era.[79][80][81]

- In February 2021, Ford announced plans to double its investment toward electric and autonomous vehicles to $29 billion through 2025. The bulk of the spending – $22 billion – is for EVs.[82]

- In March 2022, Ford decided that wasn't enough. It jacked up its EV spending to $50 billion through 2026 in a move aimed at catching industry leader Tesla, Inc.[83]

- General Motors plans to only sell EVs by 2035. It's spending $27 billion to launch 30 EV models by 2025.[84]

- Even Amazon.com is on board. It delivers 10 billion packages a year. The company said in November 2022, that its first 1,000 EV delivery vans were on the street. The vans are from an order of 100,000 electric delivery vehicles Amazon placed with Rivian Automotive, a U.S. vehicle design and manufacturing startup.[85][86]

- Honda finally announced that it was joining the electrification mega trend. The Japanese automaker said in April that it would invest about $40 billion to electrify its lineup over the next decade. Plans call for new electric vehicle models by 2030 with a sales target of more than 2 million EVs annually.[87]

- Volvo said that by 2030, it would only manufacture EVs. VolvoChief Technology OfficerHenrick Green said, "There is no long-term future for cars with an internal combustion engine."[88]

- Toyota, the world's biggest carmaker, won't get left behind. It said it plans to invest $35.2 million in a drive to sell 3.5 million EV units annually by 2030. ICEO Akio Toyoda said his company will roll out 30 EV models by 2030. That doubles Toyota's original plan to sell 15 EV models by 2025.[89]

You Don’t Have To Be A Wall Street Trader Or A Billionaire Investor To Connect The Dots Here

The staggering fact…the case for American Lithium (NASDAQ: AMLI) is this:

Across the globe, hundreds of millions of battery-powered EVs will rule the road by 2030… the International Energy Agency forecasts the number to be 350 million.[90]

That means a staggering need for metric tons of new-found lithium.

And quite frankly, in an environment of heavy demand, you could potentially close your eyes, throw a dart, and hit a lithium winner.*

And it’s why there are.

8 Strong Reasons To Put American Lithium (NASDAQ: AMLI) On Your Investment Radar Now*

- MADE IN AMERICA PROJECT – American Lithium’s large scale near surface lithium deposit is strategically located in the heart of Nevada’s premier lithium trend and near Tesla’s GigaFactory.

- SUSTAINABLE DEVELOPMENT – The project has significant environmental advantages, with access to its own water and no threatened or protected plants or wildlife.

- A LOT OF LITHIUM -- A published technical report suggests that American Lithium could have the potential to mine as much as 8.83Mt (LCE) M&I and 1.86Mt LCE inferred.[95]

- OUTRAGEOUS PRICE – Because demand is so heavy, and the future demand forecast may be heavier yet, a metric ton of lithium carbonate has been selling for $70,000. The math is staggering.[96]

- TARGET ON TONOPAH – American Lithium (NASDAQ: AMLI) controls thousands of acres of Nevada, potentially rich in lithium claystone.

- UPSIDE POTENTIAL – American Lithium is fully licensed and permitted by Nevada and the U.S. Bureau of Land Management to explore and develop its property. Moreover, it now has an advanced-level project with a preliminary economic assessment coming and a prefeasibility study in the works.[97]

- THE U.S. FINALLY GETS IT – American-mined lithium could be about to get mighty valuable. In June 2021, the U.S. rolled out a National Blueprint for Lithium Batteries. Developed by the Federal Consortium for Advanced Batteries, the blueprint guides investments in developing a domestic lithium-battery mining and manufacturing value chain.[98]

- DEMAND WILL LIKELY OUTSTRIP SUPPLY – If the average EV battery size stays constant, holding about 66 pounds, the world will need as many as 2 million metric tons of lithium per year over the next decade.[99]

Even with all these factors, lithium exploration remains a speculative and risky venture and there is no assurance of success.

The Looming Demand Crisis Could Likely Make Even Bigger Headlines

I am amused by the notion that dinosaurs that once roamed Earth are part of what became massive reservoirs of oil and gas.

Who knows what will happen to today’s climate-change-denying dinosaurs?

But here’s who won’t get left behind… ExxonMobil, Shell, and BP.

BP, the multinational oil and gas company, invested $20 million in an ultra-fast-charging battery startup, StoreDot. Then, it invested $1 billion in the United Kingdom’s EV charging infrastructure.[100][101]

ExxonMobil has developed products to support EVs. Its new MobilEV grease allows EVs to travel further between charges.[102]

Shell’s public charging network, Shell Recharge, projects to have over 500,000 charging point stations up and running across the globe by 2025. They are for consumers, with plans to locate them at supermarkets, street-charging points, and EV hubs.[103]

Those last-century dinosaurs are rushing headlong into the future.

American Lithium (NASDAQ: AMLI) could also grab its share of the future.

It’s a future that involves developing rich lithium resources on its vast Tonopah, Nevada, project area.

American Lithium’s founders had it when they walked away from a successful oil company.

Classic speculators – wildcatters.

That’s why American Lithium (NASDAQ: AMLI) is potentially an eyes-wide-open play.*

Check carefully because I recognize that young companies with great stories can carry a significant amount of risk… that risk ranges from being under-funded to having a small number of shares available to the public.

So, I’ll also never shy away from alerting you about the risks associated with investing in young companies new to the stock market. That’s why I urge you always observe my three rules for accepting microcap investing risk:

- Risk Reduction Rule #1: Never invest more than you can afford to lose.

- Risk Reduction Rule #2: Do not chase losses. That means if the prices slide, you must resist all temptation to “average down.”

- Risk Reduction Rule #3: Don’t put all your dreams on one microcap. Allocate your risk capital among a handful of stocks.

Now could be the right time to call your broker or talk to an investment adviser and have them dig into American Lithium (NASDAQ: AMLI).*

It could be a solid bet on the future. A time when we’ll never have to sing, “look at Mother Nature still on the run in twenty-thirty-three.”[104]

– Jim Woods

Investingtrends.com

Still want more information on American Lithium (NASDAQ: AMLI)?

I’d like to offer you access to American Lithium’s Investor presentation, which you can have at no charge.

I’ll also begin a free subscription for you to our online investor newsletter, InvestingTrends.com.

Sign up below to learn about this investment opportunity.

By signing up above you will receive the InvestingTrends newsletter and 3rd party advertisements. Expect up to 5 messages per week from us. You can unsubscribe at any time at the bottom of any of our emails.

ADVERTISEMENT DISCLAIMER

THIS PUBLICATION IS AN ISSUER-PAID ADVERTISEMENT. This paid advertisement includes a stock profile of American Lithium (AMLI). To enhance public awareness of AMLI and its securities, the issuer has provided Promethean Marketing, Inc. (“Promethean”) with a total budget of approximately four million one hundred twenty two thousand ninety six dollars ($4,122,796.00) USD to cover the costs associated with this advertisement for a period beginning 01/01/2020 and currently set to end [insert date]. In connection with this effort, Promethean has paid the author of this advertisement, Jim Woods, twenty five thousand ($25,000.00) USD in cash out of the total budget. The website hosting this advertisement, Investing Trends, is owned by Summit Publishing Group, Inc. (“Summit”), an affiliate of Promethean. Neither Summit nor Investing Trends have been paid to host this advertisement. As a result of this advertisement, Investing Trends may receive advertising revenue from new advertisers and collect email addresses from readers that it may be able to monetize. Promethean will retain any excess sums after all expenses are paid. Jim Woods is solely responsible for the contents of this advertisement. As of the date this advertisement is posted to the Investing Trends website, some or all of Promethean, Investing Trends, Summit, or Jim Woods, and any of their respective officers, principals, or affiliates (as defined in the Securities Act of 1933, as amended, and Rule 501(b) promulgated thereunder) may hold the securities of (AMLI) and may sell those shares during the course of this advertising campaign. This advertisement may increase investor and market awareness, which may result in an increased number of shareholders owning and trading the securities of (AMLI), increased trading volume, and possibly an increased share price of [AMLI]’s securities, which may or may not be temporary and decrease once the advertising campaign has ended. To more fully understand the Investing Trends website or service, please review its full Disclaimer and Disclosure Policy located here.

* See our Important Notice and Disclaimer above for a detailed discussion on compensation, risks, atypical results, and more.

[1] https://www.barchart.com/stocks/quotes/MLNLF/interactive-chart

[2] https://www.globenewswire.com/en/news-release/2022/01/25/2372828/0/en/Lithium-Americas-Completes-Acquisition-of-Millennial-Lithium.html

[3] https://www.bloomberg.com/news/features/2022-05-25/lithium-the-hunt-for-the-wonder-metal-fueling-evs?sref=VcSM8PCz

[4] 3,343 hectares is 12-square miles, for hectare claim see https://americanlithiumcorp.com/tlc-lithium-project/

[5] https://americanlithiumcorp.com/tlc-lithium-project/

[6] https://americanlithiumcorp.com/wp-content/uploads/2022/11/American-Lithium-Investor-Presentation-2022-V24.pdf PAGE 7

[7] https://cen.acs.org/energy/energy-storage-/Challenging-Chinas-dominance-lithium-market/100/i38

[8] https://www.nytimes.com/2021/05/06/business/lithium-mining-race.html

[9] https://www.wsj.com/articles/electric-cars-batteries-lithium-triangle-latin-america-11660141017?mod=Searchresults_pos1&page=1

[10] https://cen.acs.org/energy/energy-storage-/Canada-orders-Chinese-companies-sell/100/web/2022/11?utm_source=mostread&utm_medium=mostread&utm_campaign=CEN

[11] ttps://cen.acs.org/energy/energy-storage-/Canada-orders-Chinese-companies-sell/100/web/2022/11?utm_source=mostread&utm_medium=mostread&utm_campaign=CEN

[12] https://finance.yahoo.com/quote/LIACF/

[13] https://ca.finance.yahoo.com/quote/li.v/?guccounter=1&guce_referrer=aHR0cHM6Ly93d3cuZ29vZ2xlLmNvbS8&guce_referrer_sig=AQAAANcNoYYGzX6wYLls6p9JZzm2rMOp5hleOZW1jzIaL0b3fzr5JFGT07ewKrM7LkepNbnwbEGXAyg1Lt4v-Ixf44Afa-kqD1nshEMKMmQrbykUE-Wp0dlKV3voTjoPico-h8tsFe3JjqbGRZJ-gEX53pyGzxsmF8Ngde0Is6CeJlsD

[14] https://v50.stocktrak.com/

[15] https://americanlithiumcorp.com/wp-content/uploads/2022/11/American-Lithium-Investor-Presentation-2022-V24.pdf PAGE 17

[16] https://www.globenewswire.com/en/news-release/2022/09/16/2517759/0/en/Electric-Vehicle-Market-Size-to-Hit-USD-980-Billion-Globally-by-2028-with-a-4-80-CAGR-Says-Facts-Factors.html

[17] https://www.globenewswire.com/en/news-release/2022/10/05/2528569/0/en/Global-Renewable-Energy-Market-Size-to-grow-USD-1930-6-Billion-by-2030-CAGR-of-8-5-Spherical-Insights-Consulting.html

[18] https://www.automationalley.com/articles/the-industrial-revolution-of-electric-mobility

[19] https://americanlithiumcorp.com/wp-content/uploads/2022/11/American-Lithium-Investor-Presentation-2022-V24.pdf

[20] https://cen.acs.org/energy/energy-storage-/Challenging-Chinas-dominance-lithium-market/100/i38

[21] https://www.bloomberg.com/news/articles/2022-11-15/china-has-shot-at-seizing-60-share-of-global-ev-sales-this-year?leadSource=uverify%20wall&sref=VcSM8PCz

[22] https://www.bloomberg.com/news/articles/2022-11-15/china-has-shot-at-seizing-60-share-of-global-ev-sales-this-year?leadSource=uverify%20wall&sref=VcSM8PCz

[23] https://www.bloomberg.com/news/articles/2022-11-15/china-has-shot-at-seizing-60-share-of-global-ev-sales-this-year?leadSource=uverify%20wall&sref=VcSM8PCz

[24] https://cen.acs.org/energy/energy-storage-/Challenging-Chinas-dominance-lithium-market/100/i38

[25] https://www.wardsauto.com/industry-news/expert-warns-china-calling-shots-ev-battery-materials

[26] https://www.barrons.com/news/chile-awards-two-multi-million-dollar-lithium-contracts-01642019107

[27] https://www.thenation.com/article/world/gabriel-boric-chile-left/

[28] https://www.wsj.com/articles/electric-cars-batteries-lithium-triangle-latin-america-11660141017?mod=Searchresults_pos1&page=1

[29] https://www.thenation.com/article/world/gabriel-boric-chile-left/

[30a] https://siteselection.com/issues/2022/sep/can-nevada-become-the-lithium-capital-of-america.cfm

[30b] https://www.mckinsey.com/industries/metals-and-mining/our-insights/lithium-mining-how-new-production-technologies-could-fuel-the-global-ev-revolution

[31] https://www.mckinsey.com/industries/metals-and-mining/our-insights/lithium-mining-how-new-production-technologies-could-fuel-the-global-ev-revolution

[32] https://www.npr.org/2022/11/23/1135952359/lithium-mines-batteries-electric-vehicles-climate-change-carbon

[33] https://www.npr.org/2022/11/23/1135952359/lithium-mines-batteries-electric-vehicles-climate-change-carbon

[34a] https://www.npr.org/2022/11/23/1135952359/lithium-mines-batteries-electric-vehicles-climate-change-carbon

[34b] Image Data Source Trading Economics https://tradingeconomics.com/commodity/lithium Price of lithium as represented in Chinese Yuan Conversion to U.S. dollars, on Nov. 28, 2022 made at https://www.google.com/search?client=firefox-b-1-d&q=577500+CNY+to+USD

[35] https://www.newsecuritybeat.org/2022/06/chiles-conundrum-saving-desert-hinder-global-climate-transition/

[36] https://www.bloomberg.com/news/articles/2022-02-01/in-chile-s-big-mining-shake-up-radical-moves-remain-a-long-shot?leadSource=uverify%20wall

[37] https://www.nytimes.com/2022/02/28/world/congo-cobalt-mining-china.html

[38] https://americanlithiumcorp.com/wp-content/uploads/2022/11/American-Lithium-Investor-Presentation-2022-V24.pdf PAGE 7

[39] https://www.wsj.com/articles/electric-cars-batteries-lithium-triangle-latin-america-11660141017?mod=Searchresults_pos1&page=1

[40] https://www.wsj.com/articles/canada-orders-chinese-companies-to-divest-from-miners-after-security-review-11667427265

[41] https://www.barrons.com/articles/lithium-price-ev-demand-shortages-51664401463

[42] https://fortune.com/2022/10/19/elon-musk-lithium-shortage-refinery-in-texas/

[43] https://time.com/6182044/electric-vehicle-battery-lithium-shortage/

[44] https://www.reuters.com/technology/world-faces-shortage-lithium-electric-vehicle-batteries-2022-01-21/

[45] https://www.investors.com/news/lithium-battery-shortage-rare-earths-may-wreck-great-ev-race/

[46] https://www.cnbc.com/2022/05/18/ev-battery-costs-set-to-spike-as-raw-material-shortages-drags-on.html

[47] https://www.bloomberg.com/news/features/2022-05-25/lithium-the-hunt-for-the-wonder-metal-fueling-evs?sref=VcSM8PCz

[48] https://siteselection.com/issues/2022/sep/can-nevada-become-the-lithium-capital-of-america.cfm

[49] https://lands.nv.gov/uploads/documents/Lithium_Exploration_and_Mining_in_Nevada_Presentation.pdf

[50] https://samcotech.com/what-is-lithium-extraction-and-how-does-it-work/

[51] https://www.courthousenews.com/lithium-rush-in-nevada-could-usher-new-era-of-mining-in-the-west/

[52] https://www.barchart.com/stocks/quotes/MLNLF/interactive-chart

[53] https://www.barchart.com/stocks/quotes/PRMNF/interactive-chart

[54] https://investingnews.com/daily/resource-investing/what-is-a-pea/

[55] https://americanlithiumcorp.com/wp-content/uploads/2022/11/American-Lithium-Investor-Presentation-2022-V24.pdf PAGE 6

[56] https://www.basemetals.org/Pt2004/Papers/243_Rupprecht.pdf

[57] https://americanlithiumcorp.com/wp-content/uploads/2022/11/American-Lithium-Investor-Presentation-2022-V24.pdf PAGE 6

[58] https://batteriesnews.com/lithium-price-forecast-price-keep-bull-run/

[59] https://www.basemetals.org/Pt2004/Papers/243_Rupprecht.pdf

[60] https://goed.nv.gov/key-industries/mining/

[61] https://www.earthisland.org/journal/index.php/magazine/entry/the-rush-for-white-gold/

[62] https://thenevadaindependent.com/article/in-remote-nevada-valley-a-race-for-more-lithium-comes-down-to-waterefbfbc

[63] https://thenevadaindependent.com/article/in-remote-nevada-valley-a-race-for-more-lithium-comes-down-to-waterefbfbc

[64] https://thenevadaindependent.com/article/in-remote-nevada-valley-a-race-for-more-lithium-comes-down-to-waterefbfbc

[65] https://thenevadaindependent.com/article/in-remote-nevada-valley-a-race-for-more-lithium-comes-down-to-waterefbfbc

[66] https://www.globenewswire.com/en/news-release/2022/05/26/2451098/0/en/American-Lithium-Secures-Additional-Private-Water-Rights-for-Planned-Operations-at-TLC.html

[67] https://www.globenewswire.com/en/news-release/2022/05/26/2451098/0/en/American-Lithium-Secures-Additional-Private-Water-Rights-for-Planned-Operations-at-TLC.html

[68] https://www.globenewswire.com/en/news-release/2022/05/26/2451098/0/en/American-Lithium-Secures-Additional-Private-Water-Rights-for-Planned-Operations-at-TLC.html

[69]https://minerals.nv.gov/uploadedFiles/mineralsnvgov/content/home/features/RP/RP_CNRWA_DMRE_CPL_2022.06.17.pdf PAGE 5

[70] https://www.mining.com/filtering-technology-increases-speed-recovery-rates-from-lithium-brines/

[71] https://www.globenewswire.com/en/news-release/2021/06/29/2254603/0/en/American-Lithium-Obtains-82-Lithium-Extraction-Using-Roasting-and-Water-Leaching-on-TLC-Claystones.html

[72] https://www.globenewswire.com/en/news-release/2021/06/29/2254603/0/en/American-Lithium-Obtains-82-Lithium-Extraction-Using-Roasting-and-Water-Leaching-on-TLC-Claystones.html

[73] https://www.globenewswire.com/en/news-release/2021/06/29/2254603/0/en/American-Lithium-Obtains-82-Lithium-Extraction-Using-Roasting-and-Water-Leaching-on-TLC-Claystones.html

[74] https://www.mining.com/filtering-technology-increases-speed-recovery-rates-from-lithium-brines/

[75] https://www.mckinsey.com/industries/metals-and-mining/our-insights/lithium-mining-how-new-production-technologies-could-fuel-the-global-ev-revolution

[76] https://www.mckinsey.com/industries/metals-and-mining/our-insights/lithium-mining-how-new-production-technologies-could-fuel-the-global-ev-revolution

[77a] https://www.mckinsey.com/industries/metals-and-mining/our-insights/lithium-mining-how-new-production-technologies-could-fuel-the-global-ev-revolution

[77b] Reuters analysis of company disclosures https://www.reuters.com/business/autos-transportation/exclusive-global-carmakers-now-target-515-billion-evs-batteries-2021-11-10/

[78] Reuters analysis of company disclosures https://www.reuters.com/business/autos-transportation/exclusive-global-carmakers-now-target-515-billion-evs-batteries-2021-11-10/

[79] https://www.globalxetfs.com/lithium-explained/

[80] https://www.globalxetfs.com/lithium-explained/

[81] https://www.reuters.com/article/volkswagen-strategy/vw-boosts-investment-in-electric-and-autonomous-car-technology-to-86-billon-idUSKBN27T24O

[82] https://www.reuters.com/article/volkswagen-strategy/vw-boosts-investment-in-electric-and-autonomous-car-technology-to-86-billon-idUSKBN27T24O

[83] https://www.wardsauto.com/vehicles/volkswagen-group-ups-ev-tech-spending-100-billion

[84] https://www.motortrend.com/news/ford-ev-investment-2025/

[85] https://www.reuters.com/business/autos-transportation/ford-run-ev-ice-businesses-separately-2022-03-02/

[86] https://www.motortrend.com/news/ford-ev-investment-2025/

[87] https://www.cnbc.com/2019/09/19/amazon-is-purchasing-100000-rivian-electric-vans.html

[88] https://www.businessinsider.com/amazon-creating-fleet-of-electric-delivery-vehicles-rivian-2020-2#these-new-vehicles-are-also-great-for-drivers-they-were-designed-with-driver-input-and-feedback-along-the-way-and-theyre-among-the-safest-and-most-comfortable-delivery-vehicles-on-the-road-today-jassy-continued-5

[89] https://www.cnn.com/2022/04/12/business/honda-electric-cars-intl-hnk/index.html

[90] https://www.cnbc.com/2021/03/02/volvo-says-it-will-be-fully-electric-by-2030-move-car-sales-online.html

[91] https://www.bloomberg.com/news/articles/2021-12-14/toyota-accelerates-electric-vehicle-shift-with-30-models?sref=VcSM8PCz

[92] https://www.iea.org/reports/by-2030-evs-represent-more-than-60-of-vehicles-sold-globally-and-require-an-adequate-surge-in-chargers-installed-in-buildings

[93] https://thefly.com/n.php?id=3405752

[94] https://www.globenewswire.com/en/news-release/2022/05/26/2451098/0/en/American-Lithium-Secures-Additional-Private-Water-Rights-for-Planned-Operations-at-TLC.html

[95] https://americanlithiumcorp.com/wp-content/uploads/2022/11/American-Lithium-Investor-Presentation-2022-V24.pdf

[96] Trading Economics https://tradingeconomics.com/commodity/lithium Lithium is usually priced in Chinese Yuan the conversion of Y577500 to U.S. dollars, on Nov. 28, 2022 was made at https://www.google.com/search?client=firefox-b-1-d&q=577500+CNY+to+USD

[97] https://americanlithiumcorp.com/wp-content/uploads/2022/11/American-Lithium-Investor-Presentation-2022-V24.pdf PAGE 6

[98] https://www.energy.gov/sites/default/files/2021-06/FCAB%20National%20Blueprint%20Lithium%20Batteries%200621_0.pdf

[99] https://cen.acs.org/energy/energy-storage-/Challenging-Chinas-dominance-lithium-market/100/i38

[100] https://www.bp.com/en/global/corporate/news-and-insights/reimagining-energy/bp-invests-in-ultra-fast-charging-battery-company-storedot.html

[101] https://www.yahoo.com/video/big-oil-wants-piece-electric-210000774.html

[102] https://www.yahoo.com/video/big-oil-wants-piece-electric-210000774.html

[103] https://www.yahoo.com/video/big-oil-wants-piece-electric-210000774.html

[104] Adapted from Neil Young, After the Gold Rush, Reprise, 1970