This is a paid advertisement sponsored by American Lithium Corporation

When it Comes to Lithium… Shouldn’t the future be “Mined in America”?

Jim Woods is a 20-plus-year veteran of the markets with varied experience as a broker, hedge fund trader, financial writer, author and newsletter editor.

His books include co-authoring, “Billion Dollar Green: Profit from the Eco Revolution,” and “The Wealth Shield: How to Invest and Protect Your Money from Another Stock Market Crash, Financial Crisis or Global Economic Collapse.” He’s also ghostwritten many books and articles, as well as edited content for some of the investment industry’s biggest luminaries.

- Currently, China controls a staggering 80% of the global lithium market. In the next decade, it’s estimated that the lithium-ion battery market will be worth over $430 billion…[1][2]

- As demand for green energy grows, the spotlight shines brighter on where these critical metals come from and the appalling conditions in which some of them are mined.

- Dependence on foreign lithium sources is not only reckless, it’s dangerous.

- New legislation finally supports increased domestic production of energy metals. This will also help shift U.S. reliance away from geopolitical rivals such as China.[3]

You just witnessed the horrific conditions of the mines in a small village in the Congo.

Thousands of people digging with no safety equipment… the faces of modern-day slavery and child labor…

Mines like these are responsible for producing key minerals in the technology that powers most of the devices you use today …

Every iPhone or Samsung, every laptop, and every electric vehicle depend on key minerals and metals like cobalt, nickel, and most importantly lithium.

The mine above is focused on cobalt production.

You probably don’t realize that cobalt makes up to 20% of lithium-ion batteries.[7] Which means unless the world commits to raising their mining standards, these artisanal mines are a vital part of our supply chain.

So, what does this mean for you?

By now, you’ve probably heard that foreign nations like China control the majority of the production of these critical minerals and metals that power modern life.

But most folks don’t realize that investing in Apple or buying a new electric vehicle not only risks fueling modern day mining slavery but also lines the pockets of the Chinese governments, leaving the U.S. vulnerable.

Our very ability to continue operating in modern life is tied to unstable production and foreign governments who will never have the US’s best interests in mind.

Exposing the conditions and instability of these mines is only the first domino to fall.

You see, as our technology and transportation continue to evolve, we’ve come too far to pull back our reliance on lithium.

Even the White House is spending taxpayer dollars to “secure a Made in American supply chain for critical metals.”

That’s why, when it comes to lithium…

Our goal for “Made in America” should really be “Mined in America.”

That means finding a homegrown, domestic lithium source is an opportunity for savvy investors.

A patriotic metal play also feels good as an American.

Decades ago, America was the world’s top lithium producer[9]…

But today, we have only one large-scale American lithium mine.

Albemarle’s Silver Peak mine in Nevada produces a mere 5,000 tons of lithium annually from brine, a liquid found beneath the ground. This amounts to less than 2% of the world’s annual supply.[10]

Silver Peak’s output is enough for about 80,000 electric vehicles per year. While this may sound encouraging, consider that 370,000 battery-powered cars were purchased in the U.S. during the first half of 2022 alone.[11]

The U.S. hosts what are believed to be the world’s largest lithium deposits after those in the so-called Lithium Triangle region in South America…[12]

Yet we’ve had to import most of the lithium we need from China, Russia, and countries in South America.[13] This leaves us vulnerable.

And that’s why now could be a great time to look into mining development company American Lithium (NASDAQ: AMLI) – and its lithium exploration project located in the heart of U.S. mining country.

A patriotic metals play, to be sure…

Because American Lithium’s (NASDAQ: AMLI) potentially lithium-rich 12,300-acre swath of Nevada desert[14] could help the U.S. ramp up the lithium production vital for fueling our clean energy transition.* [15]

In a moment, I’ll share more details about the company – and why it could become a household name in the sector. But first, it’s essential to understand why domestic lithium sourcing is such a big issue for America.

Mass Adoption of Electric Vehicles

The Biden administration continues to emphasize the importance of securing a reliable and sustainable supply of the lithium necessary for electric vehicles (EVs) as well as electric power.[16]

After all, the President wants electric vehicles to make up 50% of all vehicle sales by 2030.[17]

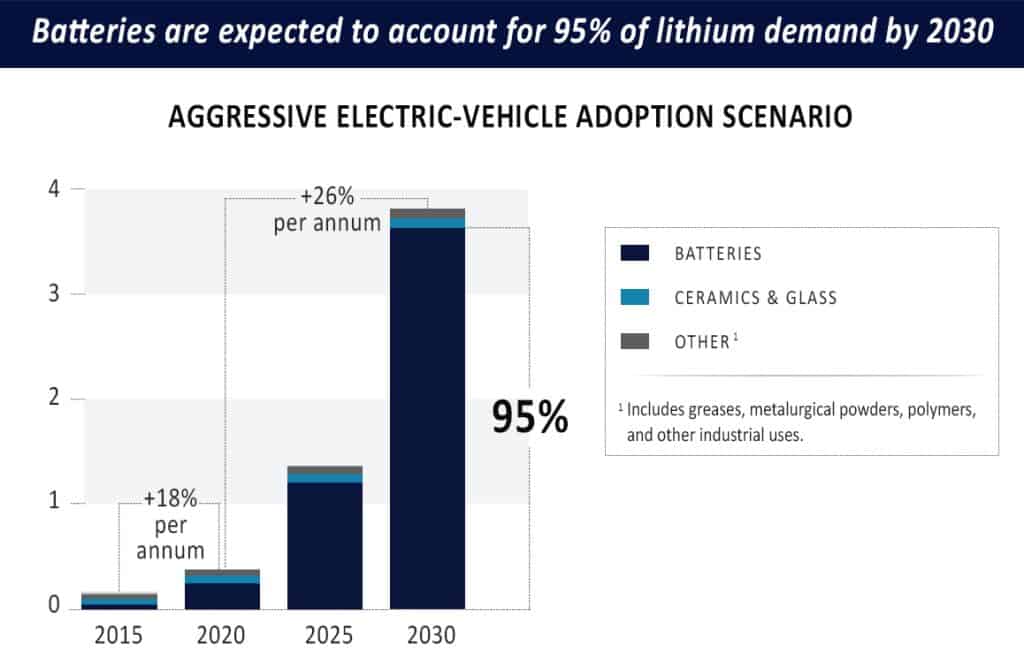

While lithium is used in consumer electronics, many types of military equipment, and the rapidly growing energy storage system market, the EV trend puts a massive strain on the market for lithium-filled batteries.

By 2033, it’s estimated that[18]:

- Battery-powered EVs will be responsible for over 90% of lithium-ion demand.

- The lithium-ion battery market will be worth over $430 billion.

Last year, the Department of Energy laid out a 10-year National Blueprint for Lithium Batteries. This plan supports the development of reliable domestic sources of lithium and other critical battery metals.[19]

The Bipartisan Infrastructure Law, CHIPS and Science Act, and the Inflation Reduction Act combined will invest over $135 billion to build America’s electrified transportation future. This includes sourcing and processing critical battery minerals such as lithium.[20]

Specifically, the 2022 Inflation Reduction Act offers incentives and subsidies to EV buyers and automakers. However, battery makers must use raw materials from North America or a country with which the United States has a trade agreement.[21]

To kick-start domestic EV production, the Department of Energy just finalized a $2.5 billion low-cost loan for a joint venture between General Motors and LG Energy Solution. The loan will help pay for three new lithium-ion battery cell manufacturing facilities in America.[22]

GM plans to build one million EVs in North America by 2025 – and stop selling gas-powered vehicles entirely by 2035.[23]

The Edison Electric Institute projects that 26.4 million EVs will be on U.S. roads in 2030.[24] This means millions of pounds of lithium will be needed.

There’s no stopping this megatrend of electrifying vehicles, making the timing right to take a hard look at companies such as American Lithium (NASDAQ: AMLI).

Uncle Sam Desperate to Break Free From China’s Dominance

According to FBI Director Christopher Wray, China is the greatest long-term threat to our country’s economic and national security.[25]

Unfortunately, China controls a staggering 80% of the global lithium market.[26] Of the 136 lithium battery plants filling the pipeline to 2029, 101 are China-based.[27]

With the increasing demand for electric vehicles and their batteries, the U.S. must break the communist country’s stranglehold on the lithium supply chain.

If China were to cut off supplies (for any reason), we might not have sufficient raw material supplies to meet our lithium demand – and the situation could become dire.[28]

And don’t forget Russia’s war against Ukraine, which reveals the folly of relying on a geopolitical foe for importing energy products.[29]

Even Chile, the world’s second-largest lithium producer,[30] could see its supply availability derailed by unfavorable politics[31] and social upheaval.[32]

That’s why I’m looking at development company American Lithium (NASDAQ: AMLI) as a potential new domestic resource for critical battery raw materials.*

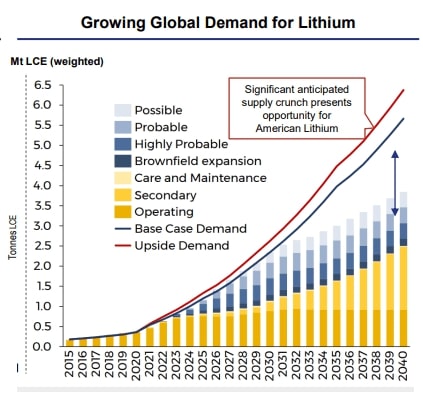

Global Lithium Supplies Cannot Meet Demand

In 2020, the total demand for lithium worldwide amounted to 292,000 metric tons of lithium carbonate equivalent.[33]

But Anthony Tse of Franklin Templeton forecasts that a decade later, by 2030, lithium demand will rise to 3-5 million metric tons.[34]

Unfortunately, trends such as electrifying transportation and creating high-tech energy storage solutions mean that supply cannot keep pace with demand.

Lithium Prices Remain at High Levels

Lithium carbonate prices climbed to all-time highs in 2021, skyrocketing by about 496% in 2021. As of November 2022, prices have risen by over 100% year-to-date.[36]

In November 2022, lithium carbonate prices reached over $80,000 per metric ton,[37] with year-end 2022 trading dropping the price to around $74,000 per metric ton.[38]

Increasing EV demand and sales continue to drive prices from the demand side. The lack of supply keeps tightening the squeeze.[39]

Albemarle (the world’s largest lithium producer) expects high prices for the key battery metal to persist for years to come.[40]

How Investors Can Get In On the EV Boom

A recent New York Times article advises investors on how to get in on the global EV trend. One suggested method is to invest in companies that mine and process the minerals that EV batteries use.[41]

I agree – and that’s where American Lithium (NASDAQ: AMLI) comes in…

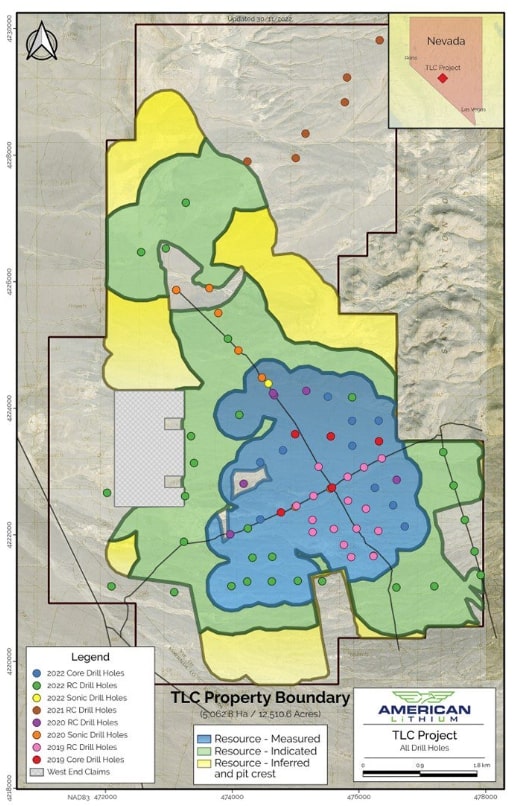

The TLC Project is a “Made in America” Lithium Deposit

The company’s strategically-located Tonopah Lithium Claims (TLC) is a lithium claystone project in Nevada’s richly mineralized Esmeralda lithium district.[43]

The 12,300-acre property, only 6 miles from the city of Tonopah, offers ready access to paved roads, electricity, and skilled labor.[44]

As part of compiling the preliminary economic assessment (PEA) based on American Lithium’s (NASDAQ: AMLI) 2022 drill programs…

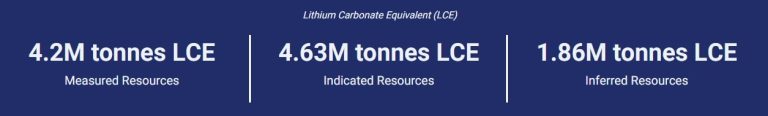

An updated mineral resource estimate released in December 2022 found that TLC hosts[45]:

- 2 million metric tons of lithium carbonate equivalent (LCE) measured resources (the highest level of confidence)

- 63 million metric tons of LCE indicated resources

- 86 million metric tons of LCE inferred resources.

Of course these potential resources are based on preliminary numbers and do not indicate economic viability. They are just a sign of progress for this exciting exploration company.

If you’ve been reading the news lately, you may have seen that opposition from environmental groups can delay or kill mining projects.[47]

That’s why minimizing environmental, social, and governance (ESG) risk factors – including water management – has become important to stakeholders and investors.[48]

Fortunately, American Lithium’s (NASDAQ: AMLI) TLC Project is a near-surface lithium deposit[49] — amenable to low-cost, sustainable mining methods. Studies indicate that their operations will not affect protected plant and wildlife species.[50]

And speaking of water management…

Around 30 companies are involved with mining proposals in Clayton Valley, Nevada.[51] This is home to the Silver Peak mine, Albemarle’s water-hungry lithium brine operation.

Because Albemarle holds nearly all water rights in Clayton Valley, there’s a contentious battle over these rights that is unlikely to be resolved any time soon.[52]

But American Lithium’s (NASDAQ: AMLI) proactive purchase of nearby properties in Big Smoky Valley near their TLC project will provide close to 2,500 acre-feet of combined water rights. This could provide sufficient water for the initial phases of future production at TLC, and create a strong base for future expansion phases.[53]

With water rights already secured – and the entire resource above the water table – the company expects no groundwater, run-off, or watershed issues.[54]

Furthermore, American Lithium’s (NASDAQ: AMLI) claystone lithium extraction process helps to minimize environmental impacts. The unique mineralogy at the TLC means the lithium is weakly bound, so it leaches very quickly — minutes instead of hours.

The leaching time to recover over 90% of the lithium is much faster than comparable lithium claystone projects. In fact, TLC demonstrated a leaching time of 10 minutes, while its closest competitor took 120 minutes. This could potentially lead to lower processing and production costs.[55]

To recap, here are…

10 Quick Facts about American Lithium (NASDAQ: AMLI) and its

“Made in America” TLC project:[56]

- 12,300-acre Tonopah Lithium Claims project in Nevada’s mining-friendly jurisdiction (just a few hours away from Elon Musk’s Tesla battery Gigafactory)

- One of the world’s largest combined lithium resource bases [57]

- Large-scale near-surface deposit (with minimal overburden and thick zones of lithium mineralization)

- Rapid processing times (up to 90% faster than competitors)

- No environmental issues found

- Water rights already secured

- Good infrastructure nearby

- Well-capitalized with strong support from major shareholders (market cap of $434.6 million as of )[58]

- Management has a proven track record of wealth builders (who’ve led and founded prominent mineral companies, including Millennial Lithium, Prime Mining, Osum Oil Sands, and others)[59]

- Stock potentially undervalued compared to peer group* ($2.04 per share as of 12/30/22[60]

Even with all these positive factors, lithium exploration remains a speculative and risky venture, and there is no assurance of success.

Young companies with great stories can still carry significant risks, ranging from being underfunded to having a small number of shares available to the public.

I urge you to always observe my rules for accepting microcap investing risk:

- Never invest more than you can afford to lose.

- Do not chase losses. If the prices slide, you must resist all temptation to “average down.”

- Allocate your risk capital among a handful of stocks rather than putting all your dreams into a single microcap.

All that said, I think you and your financial advisor will agree on one thing. American Lithium (NASDAQ: AMLI) could be a headline-making “Made and Mined in America” stock that deserves your attention.*

I wish you success in your investments.

– Jim Woods

Investingtrends.com

Still want more information on American Lithium (NASDAQ: AMLI)?

I’d like to offer you access to American Lithium’s Investor presentation, which you can have at no charge.

I’ll also begin a free subscription for you to our online investor newsletter, InvestingTrends.com.

Sign up below to learn about this investment opportunity.

By signing up above you will receive the InvestingTrends newsletter and 3rd party advertisements. Expect up to 5 messages per week from us. You can unsubscribe at any time at the bottom of any of our emails.

ADVERTISEMENT DISCLAIMER

THIS PUBLICATION IS AN ISSUER-PAID ADVERTISEMENT. This paid advertisement includes a stock profile of American Lithium (AMLI). To enhance public awareness of AMLI and its securities, the issuer has provided Promethean Marketing, Inc. (“Promethean”) with a total budget of approximately four million one hundred twenty two thousand ninety six dollars ($4,122,796.00) USD to cover the costs associated with this advertisement for a period beginning 01/01/2020 and currently set to end [insert date]. In connection with this effort, Promethean has paid the author of this advertisement, Jim Woods, twenty five thousand ($25,000.00) USD in cash out of the total budget. The website hosting this advertisement, Investing Trends, is owned by Summit Publishing Group, Inc. (“Summit”), an affiliate of Promethean. Neither Summit nor Investing Trends have been paid to host this advertisement. As a result of this advertisement, Investing Trends may receive advertising revenue from new advertisers and collect email addresses from readers that it may be able to monetize. Promethean will retain any excess sums after all expenses are paid. Jim Woods is solely responsible for the contents of this advertisement. As of the date this advertisement is posted to the Investing Trends website, some or all of Promethean, Investing Trends, Summit, or Jim Woods, and any of their respective officers, principals, or affiliates (as defined in the Securities Act of 1933, as amended, and Rule 501(b) promulgated thereunder) may hold the securities of (AMLI) and may sell those shares during the course of this advertising campaign. This advertisement may increase investor and market awareness, which may result in an increased number of shareholders owning and trading the securities of (AMLI), increased trading volume, and possibly an increased share price of [AMLI]’s securities, which may or may not be temporary and decrease once the advertising campaign has ended. To more fully understand the Investing Trends website or service, please review its full Disclaimer and Disclosure Policy located here.

* See our Important Notice and Disclaimer above for a detailed discussion on compensation, risks, atypical results, and more.

[1] https://www.onecharge.biz/blog/how-china-came-to-dominate-the-market-for-lithium-batteries-and-why-the-u-s-cannot-copy-their-model/

[2] https://www.mining.com/li-ion-battery-market-to-reach-430bn-by-2033/

[3] https://www.dw.com/en/us-has-huge-lithium-reserves-but-concerns-mount-over-mining/a-64103024

[4] https://twitter.com/siddharthkara/status/1608466232940036098?s=20&t=Y3qgdwq-90Lq1gVvbF7k4A

[5] https://twitter.com/siddharthkara/status/1608098929832525825?s=20&t=Y3qgdwq-90Lq1gVvbF7k4A

[6] https://twitter.com/TheJRECompanion/status/1608694307560775683?s=20&t=Y3qgdwq-90Lq1gVvbF7k4A

[7] https://www.cobaltinstitute.org/essential-cobalt-2/powering-the-green-economy/batteries-electric-vehicles/#:~:text=Cobalt%20is%20an%20essential%20part,containing%2010%2D20%25%20cobalt.

[8] https://www.euronews.com/green/2022/03/25/the-future-of-cars-is-electric-we-need-to-start-in-investing-in-sustainable-lithium

[9] https://www.dw.com/en/us-has-huge-lithium-reserves-but-concerns-mount-over-mining/a-64103024

[10] https://www.nytimes.com/2021/05/06/business/lithium-mining-race.html

[11] https://www.nytimes.com/2022/09/20/business/electric-vehicles-lithium-quebec.html?smid=nytcore-ios-share&referringSource=articleShare

[12] https://www.dw.com/en/us-has-huge-lithium-reserves-but-concerns-mount-over-mining/a-64103024

[13] https://www.usatoday.com/story/money/2022/10/10/lithium-gold-rush-why-important/8170196001/

[14] https://americanlithiumcorp.com/wp-content/uploads/2022/11/American-Lithium-Investor-Presentation-2022-V24.pdf

[15] This combined potential resource includes inferred amounts of lithium. These potential resources are based on preliminary numbers and do not indicate economic viability.

[16] https://www.whitehouse.gov/briefing-room/statements-releases/2022/10/19/fact-sheet-biden-harris-administration-driving-u-s-battery-manufacturing-and-good-paying-jobs/

[17] https://www.whitehouse.gov/briefing-room/statements-releases/2021/08/05/fact-sheet-president-biden-announces-steps-to-drive-american-leadership-forward-on-clean-cars-and-trucks/

[18] https://www.idtechex.com/en/research-report/li-ion-battery-market-2023-2033-technologies-players-applications-outlooks-and-forecasts/898

[19] https://www.energy.gov/sites/default/files/2021-06/FCAB%20National%20Blueprint%20Lithium%20Batteries%200621_0.pdf

[20] https://www.whitehouse.gov/briefing-room/statements-releases/2022/10/19/fact-sheet-biden-harris-administration-driving-u-s-battery-manufacturing-and-good-paying-jobs/

[21] https://www.nytimes.com/2022/09/20/business/electric-vehicles-lithium-quebec.html?smid=nytcore-ios-share&referringSource=articleShare

[22] https://www.reuters.com/business/energy/us-finalizes-25-billion-loan-gm-lg-battery-joint-venture-2022-12-12/#:~:text=WASHINGTON%2C%20Dec%2012%20(Reuters),ion%20battery%20cell%20manufacturing%20facilities.

[23] https://www.reuters.com/business/energy/us-finalizes-25-billion-loan-gm-lg-battery-joint-venture-2022-12-12/#:~:text=WASHINGTON%2C%20Dec%2012%20(Reuters),ion%20battery%20cell%20manufacturing%20facilities.

[24] https://www.eei.org/News/news/All/eei-projects-26-million-electric-vehicles-will-be-on-us-roads-in-2030

[25] https://www.fbi.gov/news/speeches/the-threat-posed-by-the-chinese-government-and-the-chinese-communist-party-to-the-economic-and-national-security-of-the-united-states

[26] https://www.instituteforenergyresearch.org/renewable/china-dominates-the-global-lithium-battery-market/

[27] https://source.benchmarkminerals.com/article/china-controls-sway-of-electric-vehicle-power-through-battery-chemicals-cathode-and-anode-production

[28] https://www.wardsauto.com/industry-news/expert-warns-china-calling-shots-ev-battery-materials

[29] https://www.cer.eu/insights/impact-ukraine-war-global-energy-markets

[30] https://www.barrons.com/news/chile-awards-two-multi-million-dollar-lithium-contracts-01642019107

[31] https://www.thenation.com/article/world/gabriel-boric-chile-left/

[32] https://www.wsj.com/articles/electric-cars-batteries-lithium-triangle-latin-america-11660141017?mod=Searchresults_pos1&page=1

[33] https://www.statista.com/statistics/1220158/global-lithium-demand-volume-by-application/

[34] https://investingnews.com/lithium-demand-keep-ballooning/

[35] https://americanlithiumcorp.com/wp-content/uploads/2022/11/American-Lithium-Investor-Presentation-2022-V24.pdf

[36] https://elements.visualcapitalist.com/charted-the-most-expensive-battery-metals/

[37] https://elements.visualcapitalist.com/charted-the-most-expensive-battery-metals/

[38] https://news.metal.com/newscontent/102047380/Aggressive-Sell-Off-Accelerates-the-Drop-in-Lithium-Carbonate-Prices/

[39] https://elements.visualcapitalist.com/charted-the-most-expensive-battery-metals/

[40] https://news.metal.com/newscontent/102052263/albemarle-is-betting-that-lithium-prices-will-remain-high-

[41] https://www.nytimes.com/2022/07/15/business/investing-electric-vehicles-batteries.html?searchResultPosition=70

[42] https://americanlithiumcorp.com/american-lithium-reports-large-increase-in-lithium-resources-at-tlc-measured-lce-resource-increases-25-indicated-lce-resource-increases-129/

[43] https://americanlithiumcorp.com/american-lithium-intersects-up-to-2900-ppm-li-in-best-results-to-date-in-thick-lithium-claystone-from-hole-tlc-2206c-averaging-1550-ppm-li-over-50-3-m/

[44] https://americanlithiumcorp.com/tlc-lithium-project/

[45] https://americanlithiumcorp.com/tlc-lithium-project/

[46] https://americanlithiumcorp.com/tlc-lithium-project/

[47] https://www.nytimes.com/2022/09/20/business/electric-vehicles-lithium-quebec.html?smid=nytcore-ios-share&referringSource=articleShare

[48] https://www.ey.com/en_us/mining-metals/esg-challenges-mining-and-metals-companies-are-facing

[49] This combined potential resource includes inferred amounts of lithium. These potential resources are based on preliminary numbers and do not indicate economic viability.

[50] https://americanlithiumcorp.com/tlc-lithium-project/

[51] https://thenevadaindependent.com/article/in-remote-nevada-valley-a-race-for-more-lithium-comes-down-to-waterefbfbc

[52] https://thenevadaindependent.com/article/in-remote-nevada-valley-a-race-for-more-lithium-comes-down-to-waterefbfbc

[53] https://americanlithiumcorp.com/american-lithium-secures-additional-private-water-rights-for-planned-operations-at-tlc/

[54] https://americanlithiumcorp.com/tlc-lithium-project/

[55] https://americanlithiumcorp.com/wp-content/uploads/2022/11/American-Lithium-Investor-Presentation-2022-V24.pdf

[56] https://americanlithiumcorp.com/wp-content/uploads/2022/11/American-Lithium-Investor-Presentation-2022-V24.pdf

[57] This combined potential resource includes inferred amounts of lithium. These potential resources are based on preliminary numbers and do not indicate economic viability.

[58] https://finance.yahoo.com/quote/NASDAQ: AMLI/

[59] https://americanlithiumcorp.com/wp-content/uploads/2022/11/American-Lithium-Investor-Presentation-2022-V24.pdf

[60] https://finance.yahoo.com/quote/NASDAQ: AMLI/